Inside: Are you seeking to attain monetary liberty? This guide teaches you the 12 habits you need along the journey. Discover how people changed their lives with simple steps of savings and lessened costs. Accomplishing monetary flexibility is often misinterpreted as merely building up great wealth.

Nevertheless, as David Bach, a renowned economist and top-selling author stresses,”Financial Freedom has to do with a lot more than money, it has to do with living a richer life.”Undoubtedly, real monetary freedom is not solely dictated by the figures in your savings account, however more by the ability to live life on your terms

, unencumbered by monetary restraints. There are factors financial freedom is a sought after objective for numerous. Having more than enough monetary resources to fund your desired lifestyle without being driven by

the requirement to make a certain quantity every year can be liberating. This post will describe financial flexibility thorough, its benefits, the keys, and basic strategies to attain it.< img width=" 683 "height =" 1024 "src="// www.w3.org/2000/svg'%20viewBox='0%200%20683%201024'%3E%3C/svg%3E" alt="Are you seeking to accomplish monetary flexibility? This guide teaches you the 12 practices you need along the journey. Find out how people altered their lives with basic steps of

savings and reduced costs.”/ > This post may contain affiliate links, which assists us to continue offering relevant content and we receive a small commission at no cost to you. As an Amazon Partner, I make from certifying purchases. Please read the complete disclosure here. What is Financial Flexibility? Financial flexibility is comprehended in various methods depending on people's personal objectives and worths. Basically, it's having adequate savings, money, and investments to live as preferred, both presently and

in the future. Those who reach financial flexibility discover themselves in control of their money, not permitting it to manage them. Picture enjoying your preferred pastime, traveling, or simply relaxing without worrying about cash. That's the essence of monetary flexibility.

Why is Financial Liberty Good? Financial flexibility is a game-changer. It provides you total control over your financial resources, permitting you to choose that align with your values and long-lasting strategies. Financial self-reliance lowers stress and anxiety tied to unanticipated expenses and uses a safeguard throughout unanticipated challenge. It likewise allows you to deal with your terms, pursue passions, take dangers, and eventually, results in

a more satisfying and happier life. This is something I can vouch for when my husband was able to leave a toxic workplace on his terms.

What is the crucial to financial liberty?

The essential to monetary freedom lies in achieving financial literacy, prioritizing your objectives, and cultivating excellent monetary practices. This includes setting and being adamant about your life goals, living within your ways, conserving vigilantly, investing carefully, diversifying earnings streams, and frequently reviewing and changing your monetary

plan. Control over your financial resources and notified choices

lead the way toward financial freedom. 12 Simple Methods for Financial Liberty Accomplishing financial liberty needs strategic planning and disciplined execution. It's not practically making more, but about saving sensibly, investing carefully, and investing wisely.

This area presents you to key strategies for securing monetary independence, illustrating their significance and demonstrating their function in leading the way towards a stress-free financial future.

Keep in mind, financial flexibility is not almost a wealthy lifestyle, however about taking control of your financial resources, making your money work for you, and living a life by yourself terms.

Something we emphasize around here at Money Happiness.

1. Set Life Goals

Setting clear, concrete life objectives– both big and small, financial and lifestyle– is the first step towards achieving financial flexibility. These clever objectives form the backbone of your monetary plan.

For example, you may desire own a house, increase your liquid net worth, or retire early. The more specific your goals, with concrete quantities and due dates, the higher the likelihood of attaining them.

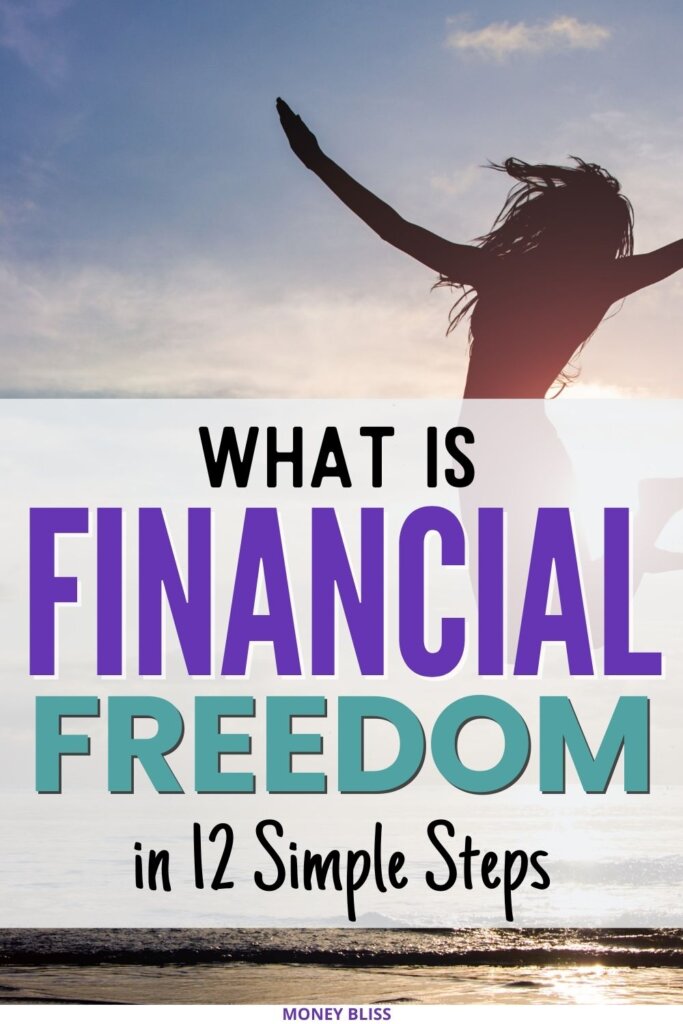

2. Develop a Month-to-month Budget Plan

Developing a month-to-month budget plan is a crucial action towards financial flexibility. Start by appraising all your income like your income and expenditures. Recognize non-essential products you can lower, and set cash aside for emergency situations and cost savings. Concentrate on mindful costs and suppress the desire to splurge. Following a month-to-month budget assurances that all costs are paid, and cost savings are progressing at a solid speed. Get solid budgeting suggestions to help you begin. 3. Invest Less Than You Earn To reach monetary liberty, it's basic to spend less than you earn. This suggestion might appear excessively easy, however it lays the foundation for wealth accumulation.

I can not stress this concept of investing less and saving more enough. By lowering discretionary costs and accepting frugality where possible, you optimize cost savings.

This doesn't indicate an austere life but just cutting back on unnecessary expenditures to produce more room for cost savings and financial investments.

4. Invest in Your Future

Investing is a course towards developing wealth for your future. Even percentages invested sensibly can have big outcomes, thanks to the power of substance interest.

Whether it's property, the stock exchange, or shared funds, investing can produce an earnings stream and considerable long-lasting growth. This also suggests increasing your monetary literacy to bring instructions and discipline to your investment journey.

Learn how to begin investing 10K.

Discover to trade stocks with confidence.Whether you want to: Retire in peace without monetary stress and anxiety

over once again, and the 30,000 students that Teri has actually helped to be economically

independent and meet their financial dreams are my witnesses …< img src="// www.w3.org/2000/svg'%20viewBox='0%200%20500%20500'%3E%3C/svg%3E "height ="500"width=

“500”alt =”Trade and Travel 2.0″/ > 5. Stay Educated on Financial Issues

Remaining mindful to monetary news and developments is essential. Knowing existing patterns can aid in timely adjustments to your financial investment portfolio.

Remaining informed on financial concerns and increasing monetary literacy is a reliable action toward attaining financial freedom. This consists of getting proficiencies in areas such as understanding debt, budgeting, tracking cash flow, and investing sensibly.

From changes in tax law to swings in the stock market, keep informed to make well-rounded financial choices. Remember, understanding is your finest security against fraud or investing mistakes.

6. Develop Passive Earnings Streams

In your hunt for monetary freedom, establishing passive earnings streams can be a terrific advantage.

Passive earnings refers to revenues stemmed from a rental property, offering printables, or other enterprises in which you're not actively included. This could be writing a book, starting a blog, or buying stocks.

These income streams can drastically enhance your earnings and aid your journey to financial liberty.

7. Diversify Your Investments

Diversifying your financial investments is a key strategy to mitigate danger and possibly increase returns. Keep in mind the statement of don't put all of your eggs in one basket.

Portfolio diversification includes spreading financial investments across different asset classes– such as cash, stocks, bonds, and real estate. Diversity makes sure slumps in a single area will not ravage your finances.

The best tool to track your financial investments would be Empower and you can utilize it totally free.

Empower deals powerful tools to help you prepare your investment method along with standard budgeting functions and an excellent net worth tool. As a free app, Empower can assist you to conserve money,

Empower deals powerful tools to help you prepare your investment method along with standard budgeting functions and an excellent net worth tool. As a free app, Empower can assist you to conserve money,

make more money. Get Started Empower Personal Wealth, LLC(“EPW” )compensates Money Bliss for brand-new leads. Cash Happiness is not a financial investment customer of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

8. Preserve Your Home and Health

Maintaining your residential or commercial property and health is vital to your financial health. Routine care and maintenance for your homes, like homes and automobiles, assistance prevent expensive repair costs in the future.

Investing effort and time in your health, with routine medical professional check outs, a healthy diet, and exercise, prevents long-lasting pricey health issues, protecting your financial future. This is why I decided to share my back combination journey to help others due to the fact that your health is crucial to your wealth.

This financial investment is essential to a life of financial liberty.

9. Build a Retirement Cost Savings Plan

< img width=" 600"height=

“400 “src=” https://moneybliss.org/wp-content/uploads/2023/11/pp-22-16.jpg.jpg “alt =” Picture of constructing a retirement saving prepare for the future.”/ > Building a robust retirement cost savings plan is a substantial action towards financial freedom.

Contributing to a 401 (k)or an IRA can lead to tax advantages while saving for retirement. Here is the essential to success: don't wait to begin conserving for retirement till you seem like you have additional money lying around. Since that will never ever happen. Start simple by maxing out your Roth IRAs and contributing enough to your employer's 401k to receive any matching.

Initiate early and let the compounding interest work in your favor for a safe and secure retirement fund. 10. Compute Your Financial Independence Number Your financial self-reliance number is a benchmark for your monetary freedom objectives. I'll be sincere this is among the hardest things to do is calculate how much you need to retire.

Just recently, I had a discussion with somebody who retired early and she said it is so difficult to understand how much you require and then also live off your cost savings.

Nevertheless, computing this FI number can supply a roadmap for your financial flexibility journey.

11. Increase Your Income

Increasing your earnings can accelerate your journey to financial freedom. Around here at Money Bliss, we stress the need for multiple streams of income.

- Consider requesting for a raise, handling more duty at work, or finding out new skills to command a greater salary.

- Check out side hustles fitting your skills and interests. This might result in a new career for you!

- And don't ignore passive earnings.

Getting more earnings not just enhances your lifestyle today but likewise increases your cost savings and financial investments for a financially free tomorrow.

12. Frequently Evaluation and Adjust Your Financial Plan

Your financial plan is not a fixed file but a living, altering guide. As your life and objectives progress, so ought to your financial technique.

Frequently reviewing your plan helps evaluate your development, make essential changes, and keep you concentrated on your monetary flexibility journey.

This is something you require to prioritize on your calendar.

Handling Debt in the Course of Financial Liberty

Our journey of trainee loans was deeply linked with our pursuit of monetary self-reliance as we wanted more cash

in our spending plan. This systematic approach not only expedited our progress but also instilled a discipline that prepared us for a future of accountable financial decisions. While challenging, it is best to pay off financial obligation quicker than later on. Focus On Paying Off Financial Obligations Attending to financial obligation is crucial on your monetary freedom journey. Prioritize settling debts, particularly high-interest ones. This could mean downsizing your way of life temporarily. You may find methods like the debt snowball approach, settling the smallest debts initially, efficient. Or the financial obligation avalanche as we picked. Find out which method to debt payments is best for your scenario.

Cleaning financial obligations minimizes regular monthly bills and creates more space in your budget plan for saving and investing.

Decrease Dependence on Borrowings

If you are regularly relying on financial obligation techniques to make ends meet, that requires to stop. Rather of taking loans for substantial purchases, it's more useful to build up cost savings first and then purchase in cash. For instance, when looking at car loans, the rate of interest is pretty high, so this is a great example to conserve initially.

This is backwards of what most people do. Nevertheless, it supplies wise decisions with your money like having an emergency situation fund to draw on.

Just to note … for most people, a home mortgage may be more affordable than leasing in their area.

Dedicate to Financial Obligation Free Living

Dedicating to a debt-free way of life is not about compromising whatever today for tomorrow, however about making smarter monetary options. These include fully settling charge card monthly, preparing a budget and sticking to it, and methodically settling any existing financial obligations.

With time, these actions lead to a decrease or elimination of debt contributing substantially to your financial liberty.

Just remember … being financial obligation totally free is your path to wealth.

Achieving Financial Freedom: Success Stories

There is no lack of motivating stories of people going from rags to riches or getting rid of financial hardships to achieve financial freedom. One noteworthy example is the story of Grant Sabatier, who went from having only $2.26 in his checking account to reaching financial self-reliance in simply five years.

There are various success stories affirming the attainability of monetary flexibility. These success stories motivate and offer important insights into attaining financial freedom.

Regularly Asked Concerns (FREQUENTLY ASKED QUESTION)

Produce Financial Liberty Journey for Yourself

Accomplishing financial freedom is a journey, not a location. It demands constant effort, discipline, and wise decision-making. Every action you take towards decreasing financial obligation, saving, investing, or making more income brings you closer to a life self-directed rather than determined by financial constraints.

You have the opportunity to alter your household's future for lots of generations to come.

Although difficulties will arise, keep in mind, as Arthur Ashe when said, “Start where you are. Use what you have. Do what you can.” With decision, you can attain monetary flexibility.

Start by learning to end up being economically independent and grow from there.

Know someone else that requires this, too? Then, please share!!

Did the post resonate with you? More importantly, did I respond to the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not simply invited; they're an important part of our community. Let's continue the discussion and explore how these ideas line up with your journey towards Money Bliss.